Decoding the GRM Overseas-Rage Coffee Deal: What’s Brewing?

PART I - Understanding the Deal

1. Broad Deal Contours: GRM’s Strategic Bet on Rage Coffee

GRM Overseas, through its 10X Ventures platform, is acquiring a significant minority stake in Swmabhan Commerce Pvt Ltd (Rage Coffee) as part of its strategy to diversify into branded consumer products.

Target: Swmabhhan Commerce Pvt Ltd (Rage Coffee)

Acquirer: GRM Overseas Limited (10X Ventures platform)

Target’s Primary Business: Sale of retail specialty coffee (instant coffee hero product) through offline and online channels

Acquirer’s Primary Business: Export of Basmati Rice (private labelling) to MENA region & sale of consumer staples through 10X brand

Stake Acquired: 44% (Significant minority stake) - Announced on August 2024

Transaction Type: Strategic acquisition aimed at long-term growth in branded consumer staples, specifically targeting D2C brands

Consideration Type: Cash consideration (To be completed within 1 year)

Acquisition Mode: Combination of primary infusion and secondary buyouts

2. Valuation Scenarios and Deal Structure

Potential deal scenarios considering different valuations and primary/ secondary mixes.

GRM Overseas’ 10X Ventures platform is looking to invest INR 200 Cr with a ticket size between INR 20 and 40 Cr, Rage Coffee being the first investment.

Although the exact valuations for Rage Coffee have not been disclosed, we can make an informed estimate.

Estimated Investment Size: Let’s consider the upper-band ticket size of INR 40 Cr to be the total investment.

Initial Estimate: A pure secondary transaction would suggest a pre-money valuation of around INR 90 Cr (INR 40 Cr / 44%).

Valuation Range: Since some primary infusion is involved, the pre-money valuation will be lower, likely ranging between INR 70 Cr to INR 90 Cr.

Scenario 2 (in the table attached) with a pre-money valuation of INR 80 Cr, seems the most likely as it balances a primary infusion and a decent secondary exit for the institutional investors.

3. Fundraising Journey & Valuation Evolution

Terms of different Pre-Series A CCPS issued by the company (Source: Company's FY23 Annual Report)

Let’s take a look at the amount of funds raised by Rage Coffee and the previous valuation:

Total Funds Raised: ~INR 60 Cr raised across FY22 and FY23 from marquee investors such as Sixth Sense Ventures and Refex Capital.

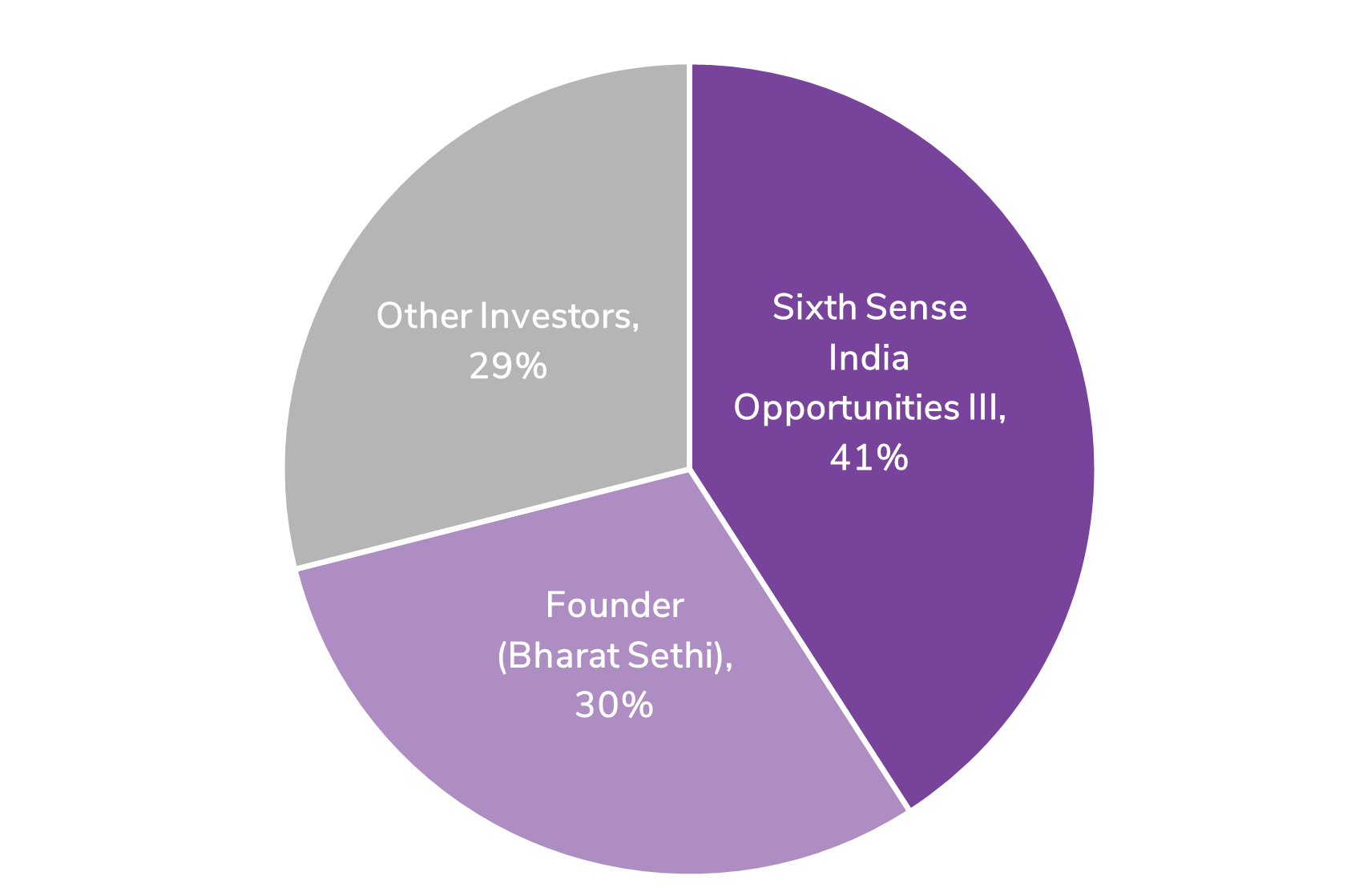

Sixth Sense Ventures Investment: Total investment of ~INR 40 Cr ($5 Mn) for a fully diluted 41% stake. Close to 19% of stake held by Sixth Sense is in the form of Pre-Series A1 CCPS which has superior conversion rights.

Pre-Series A1 CCPS Conversion Terms: These shares convert at a maximum valuation of INR 120 Cr or a 30% discount to pre-money valuation of qualified financing round.

Previous Round Valuation: Based on the above points, we can estimate a post-money valuation of INR 100–120 crore.

4. Who are the Selling Shareholders?

While the specific details of the selling shareholders in this transaction remain undisclosed, we can make a few informed assumptions:

Sixth Sense Ventures is the largest shareholder with a fully diluted stake of ~41%. In a filing, GRM Overseas had also mentioned that it is currently the single largest shareholder post the transaction. This suggests that Sixth Sense has at least partially exited, potentially achieving flat returns over the past 3 years.

Another interesting point to note is that Sixth Sense’s founder, Nikhil Vora, had participated in GRM’s recent INR 136 Cr share warrants issue which was announced just a few months prior to the Rage Coffee announcement, with a personal investment commitment of INR 3 Cr from his HUF.

Also, as Sixth Sense also holds Pre-Series A1 CCPS shares with more favorable conversion terms (as mentioned earlier in point no 3 above), they have an opportunity to recover any potential losses as long as the company grows in the future.

Shareholding pattern of Rage Coffee as on 31st March 2023 (Source: Company's FY23 Annual Report)

Snippet of the participating investors in the share warrants issued by GRM (Source: Company filings)

5. Deal Rationale

Ideally, I would request you to read through the entirety of PART II & PART III to better understand the rationale behind the deal, but for those with limited time to spare, the rationale is hyperlinked below:

Rage Coffee POV: Click here to be teleported to the rationale

GRM Overseas POV: Click here to be teleported to the rationale

PART II - A Sip of Trouble: Decoding the Real Story Behind Rage Coffee’s Stake Sale

Founded in 2018 by Bharat Sethi, Rage Coffee started as a direct-to-consumer brand and was known to be the world’s first plant-based vitamins coffee brand. The company uses single-origin Arabica beans (sourced from Ethiopia & Chikkamagaluru), crystallized (patent pending process) & infused with vitamins such as L-Theanine, Bacopa Monnieri, Ginko Biloba, Rhodiola, Panax Ginseng, L-Glutamine. Currently present across all major marketplaces, 1,500+ MT outlets, 200+ distributors & 20,000+ GT outlets.

1. Brewing the Big Picture: The Coffee Market Breakdown

Before we jump into Rage Coffee’s story, let’s zoom out and take a look at the coffee market itself. Bear with me, understanding the broader trends and dynamics will give us a clearer picture of the challenges and opportunities that companies like Rage Coffee are navigating.

Global Trade: Brazil and Vietnam produce over 50% of the world’s coffee, while India accounts for about 3%. Over 80% of coffee is consumed by Europe and the USA. India is the 7th largest producer, growing Arabica & Robusta.

Low Consumption: India’s per capita consumption is just 0.07 kg, far below the global average of 1.3 kg. In terms of cups, India consumes 30 cups a year versus 200 globally.

Regional Concentration: Karnataka, Kerala, and Tamil Nadu produce 97% of India’s coffee, with Karnataka alone contributing 71%.

Export Focus: 75% of India’s coffee is exported as unroasted beans.

Southern Dominance: 75-80% of Indian coffee is consumed in the southern states, where per capita consumption is 3-4 times the national average.

Instant Coffee Trend: Instant coffee now makes up 65% of coffee consumption in 2022, up from 18% in 2010.

Chicory Mix: 75% of coffee consumed (2022) in India is chicory-blended (up from 25% in 2010), due to 10x lower cost & the earthy flavor imparted.

Duopoly: India’s instant coffee market is dominated by Nestle (Nescafe, Sunrise) and HUL (Bru), together holding over 93% market share, followed by CCL Products (Continental Coffee) at 4-4.5% market share.

Sources: International Coffee Organization, Coffee Board of India, CRISIL MI&A report

A price-sensitive market dominated by two giants, where regionally concentrated consumption meets a love for chicory-heavy cheap blends—perfect for new brands to thrive, right? Yeah, not quite.

2. Navigating the Coffee Value Chain: The Blend Behind the Beans

In the coffee value chain, producers and processors remain largely separate, with limited backward integration. Brands often set up processing and packaging facilities, but their primary focus is still on marketing and branding, which leaves them vulnerable to raw material price volatility.

Most new-age coffee brands are going omni-channel and exploring exports, as many struggle to surpass the INR 50 Cr revenue ceiling despite years in the market as digital-first brands.

For the purpose of this article I will be comparing Rage Coffee with its closest peer, Sleepy Owl, which is similar in terms of age, scale, product portfolio.

Coffee value chain across producers, processors & exporters/brands

(Source: Nguyen and Sarker International Journal of Corporate Social Responsibility 2018)

Rage Coffee’s 30,000 sq. ft. 3 floor facility at IMT Manesar (houses packaging, production, and warehousing)

3. The Conquest for TAM & AOV: Expanding Beyond Instant Coffee

To grow their Total Addressable Market (TAM) and increase Average Order Value (AOV), brands are diversifying into adjacencies like ready-to-drink coffee, cold brews, snacks, small packs and accessories. However, success has been limited. For instance, Rage Coffee ventured into snacking with caffeine bars and cookies in FY22, but these products have since been discontinued, reflecting the challenges of scaling beyond core offerings.

Increasing product portfolio to capture a larger audience (Source: Rage Coffee Website)

Similar to Rage Coffee, SleepyOwl has been expanding its product mix (Source: Sleepy Owl Website)

4. Scaling Struggles: Educating a Price-Sensitive Market & Limited Customer Base

As new-age coffee brands try to scale, I believe they face three major hurdles:

Lack of Public Education: Most Indian consumers don’t fully understand coffee types, roasting levels, or brewing methods, making it hard for brands to communicate the value of premium coffee.

Price Sensitivity: Competing with brands like Nescafe and Bru, which offer coffee at a fraction of the price, premium brands struggle to justify charging 2x-3x prices (₹500/100g), especially in a market where consumers favor affordability.

Limited Target Audience: Value-added products, like 100% Arabica & freeze-dried coffee, appeal to a niche market. Majority of consumption is confined to India 1 (120 Mn people) and an even smaller sub-set for retail specialty coffee. This inhibits mass adoption.

Excerpt from Blume Indus Valley Report 2024 capturing the breakdown of India1 (120 Mn people) and showcasing consumption concentration.

Segmentation of brands by price points and type of coffee served. 0-200 controls a major share of the retail coffee market (Source: Redseer)

5. Topline Challenges: Flatlining Revenues and Pricing Pressures

Despite product expansions and an expanding omnichannel presence, Rage Coffee's revenues have flatlined over the last three years, hovering around the ₹20-25 Cr range (refer to the chart).

“The moment you’re following the same grammage, the same pack size, the same pack format as competition in the market you are benchmarked very quickly against what the competition is doing”

This intense competition among digital-first coffee brands has resulted in stagnant pricing. In fact, Rage Coffee’s hero product (original blend instant coffee) on Amazon has either held steady or even dropped in price over the last five years, showing how brands struggle to increase prices in line with inflation (refer to the price chart).

It is also assumed that a certain % of discount (20%-25%) will always be present and considered as a part of doing business, further hurting brand image and putting substantial pressure on margins.

In a D2C conference hosted by Ambit Capital in January 2022, some forward looking revenue targets were mentioned by the founders:

Sleepy Owl: Target to reach INR 5 Bn (500 Cr) in sales over the next 3-5 years (FY25-FY27).

Rage Coffee: Targeting INR 5 Bn (500 Cr) topline by FY25 through a mix of online and offline channels.

However, given the current scale (<10% of targeted revenue), it would be safe to assume that reaching the target would be an uphill battle.

Revenues (INR Cr) over the last 5 years as per MCA filings. FY24 number for Rage Coffee taken from GRM Overseas' filing.

6. Gross Margin Squeeze: Rising Costs, Stagnant Prices, Falling Margins

With no backward integration and stagnant product prices, new-age coffee brands like Rage Coffee and Sleepy Owl are exposed to the volatility in raw material prices. Since 2019, the price of Arabica beans—the main ingredient for these brands—has nearly doubled, rising from ₹238/kg to ₹423/kg (see the price chart).

As a result, gross margins for both brands have taken a hit. Rage Coffee’s margins have dipped from 73% to 51%, and Sleepy Owl’s from 69% to 44% over the last 5 years as shown in the gross margin chart. It’s channel revenue split has been 50%:50% across online and offline channels since FY22 so the decline in gross margin also cannot be attributed to any increase in offline sales.

~2x increase in Arabica seed prices from 2019 to 2023 (Source: CRISIL Research) owing to climate change & bad weather across Brazil & Vietnam

Gross margin % decline over the years as per MCA filings

“Anything lower than 40% (gross margins) there is no point doing business, anything above 60%, golden.”

7. EBITDA Margin Struggles: A Question of Sustainability

With falling gross margins and limited scale, both Rage Coffee and Sleepy Owl are facing worsening EBITDA margins. As gross margins shrink, operating costs like employee expenses and other expenses weigh heavily on profitability. This declining trend raises questions about the long-term sustainability of these businesses, as scaling without healthy margins remains a significant challenge (refer to the EBITDA breakdown tables).

Rage Coffee - EBITDA Margin breakdown (Source - MCA Filings)

Sleepy Owl - EBITDA Margin breakdown (Source - MCA Filings)

8. Rising Marketing Costs and Team Downsizing

Contrary to D2C expectations, both Rage Coffee and Sleepy Owl have seen ad spend as a percentage of revenue increase over the years, with worsening RoAS (Return on Ad Spend). This suggests low customer retention and higher customer acquisition costs (CAC), signaling drop in marketing efficiency despite certain level of brand maturity.

At the same time, both companies have undertaken significant cost-cutting measures, reducing their workforce by over 60% from their March 2022 peak, as indicated by EPFO data.

Worsening ad spend % and RoAS metrics (Source - MCA filings)

Decline in team size (count) as per EPFO filings

9. Runway Concerns: Funding Burn and What’s Left

Since its inception, Rage Coffee has raised around ₹55 - 65 Cr in equity funding up to FY23. Of this, ₹50-55 Cr has been burned through operational expenses, mainly advertising. Additionally, the company spent ₹2 Cr on setting up its facility and ₹2 Cr on acquiring the 'RAGE' trademark from the brand 'Rage Chocolatier' in FY22. Interestingly, the company had INR 7.36 Cr blocked in its short term assets as ‘balance with government authorities’ (as at end of FY23).

With ₹7.6 Cr in cash remaining at FY23 year-end and ongoing cost-cutting measures (as evident from above team downsizing), Rage Coffee’s estimated runway is at 12-24 months from the end of FY23. Given 18 months have passed by October 2024, the company faces a critical period ahead.

10. Deal Rationale : Rage Coffee’s Perspective

Let’s dive into the key rationale behind Rage Coffee’s decision to sell a significant stake to GRM Overseas, covering various strategic, financial, and operational factors driving the move:

Investor Pressures & Funding Challenges: Facing limited growth over the past 3-4 years, Rage Coffee’s investors likely sought a partial exit. In a tough funding environment for loss-making D2C brands, securing institutional capital at favorable terms must have been challenging. Partnering with GRM Overseas provided a strategic solution, offering better valuations through a listed partner and future access to public funding mechanisms like QIPs to fuel further growth.

Extending Runway: With limited cash reserves as of FY23 year-end, combined with the ongoing burn in marketing and employee costs, Rage Coffee’s runway appears tight despite reporting EBITDA profitability in Q1 FY24. While this ensures the company can sustain current operations, rapid expansion plans are doubtful without additional funding.

Kiosk Setups & International Marketing: The company has ambitious projects, such as opening 2,000 kiosks across 90 non-metro cities over the next three years, requiring approximately INR 30 Cr for the 600 kiosks under the COCO format. Furthermore, Rage has planned INR 3 Cr in marketing spend for its international expansion across the UK, GCC, Nepal, Bhutan, and Sri Lanka which it has entered in H1 FY24.

Leveraging GRM’s European Retail Network for Faster Global Expansion: GRM Overseas has well-established partnerships with key European retailers such as Sainsbury’s, Tesco, ASDA, and Walmart providing Rage Coffee with an existing platform to fast-track its entry into the European market.

Tapping into GRM’s MENA Stronghold: With over 70% of GRM’s revenue coming from the MENA region (being the 2nd largest exporter of Basmati rice in MENA), it has a robust distribution network across the Middle East.

Boosting Domestic Reach Through GRM’s Network: With GRM’s extensive domestic distribution network—covering over 1 lakh retail touchpoints, 125+ distributors, and partnerships with platforms like Udaan and Walmart—Rage Coffee can significantly strengthen its offline presence. This synergy is crucial, as 90% of coffee in India is purchased through offline channels. By leveraging GRM’s reach, Rage Coffee can effectively push its small-pack products (₹2-₹5) to the same consumer staples touchpoints.

PART III - GRM Overseas’ Bold Brew: The Rationale Behind Rage Coffee Stake Acquisition

Incorporated in 1995, GRM is engaged in milling, processing and distribution of basmati rice in domestic and overseas market. Third largest rice exporter in India & 2nd largest rice exporter to MENA region. The domestic business is conducted under their flagship brand-name 10X offering rice, spices, atta, and Ready-to-Eat products. It has presence in over 42 countries through a wide range of distribution network from offices in UK, US, and Middle East.

1. The Indian Rice Landscape: A Game of Exports

Before we get into GRM Overseas, it’s important to understand the rice market landscape (specifically basmati rice) . This is a commodity business, and unlike coffee, it’s all about exports, government policies and other macro-economic factors.

India is the largest rice exporter, shipping non-basmati rice mainly to Africa and basmati rice to the Middle East.

India holds an 80% share in global basmati rice exports, while Pakistan accounts for the remaining 20%.

Basmati rice is primarily exported. Of the 6.5 million tons produced annually, around 5 million tons are exported, while 0.5 million tons are consumed domestically and the rest carried over. In Kharif 2024, production rose to 8 million tons, with 5.25 million tons exported.

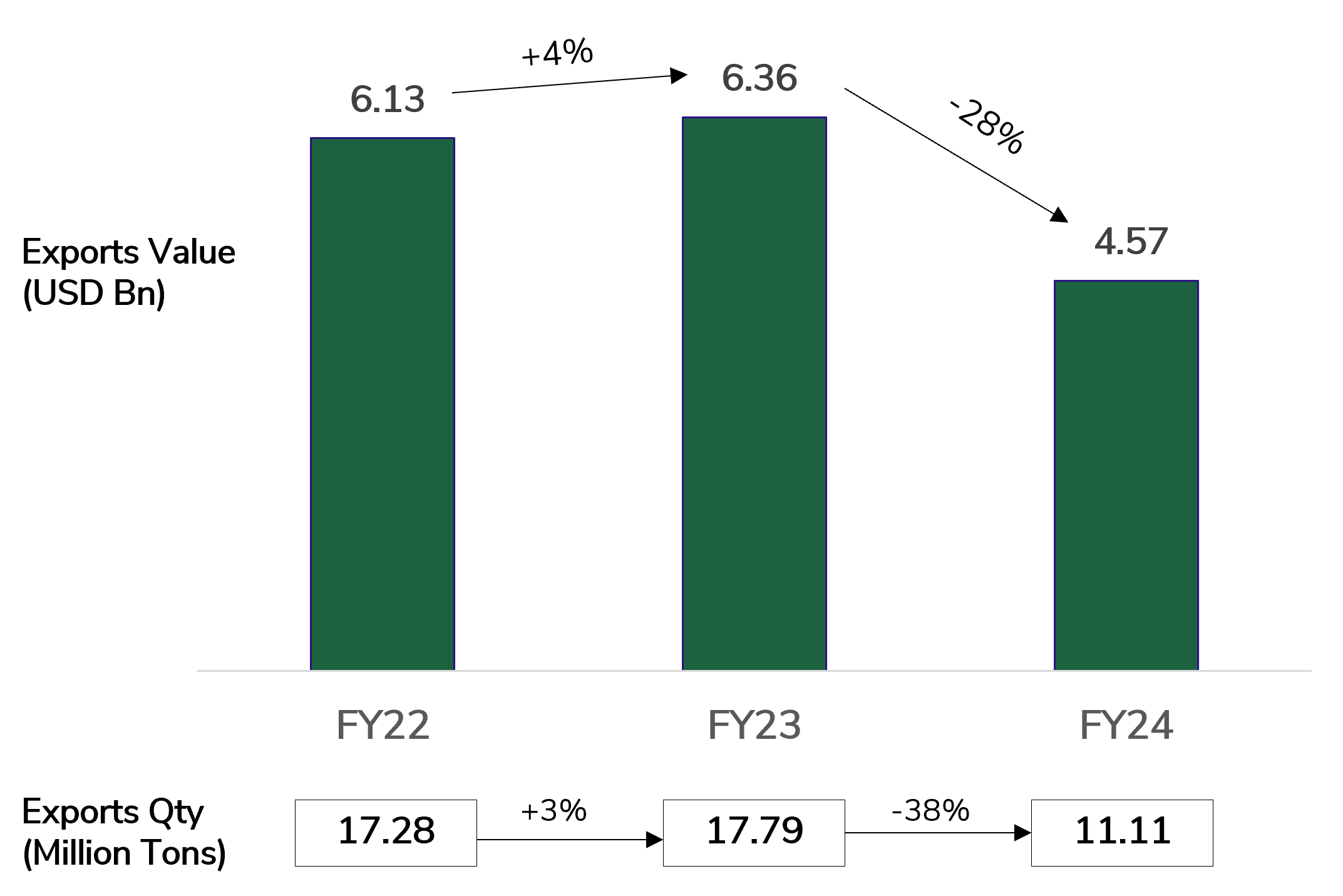

As you can see from the graphs below, there has been a substantial growth in Basmati rice exports (65% growth in value & 33% volume growth over 2 years) versus a major decline in Non-Basmati rice exports due to an export ban (more on this in point no. 3)

Basmati Rice (PC Code A3) increasing export values & quantities (Source: A Brief Report on Export of Rice by India Aug 2024)

Non-Basmati Rice (PC Code A4) substantial decline due to export ban (Source: A Brief Report on Export of Rice by India Aug 2024)

2. Basmati Rice Exports: It’s All About the Middle East

To truly understand GRM Overseas and its operations, it’s essential to grasp the pivotal role the Middle East plays in India's basmati rice exports:

70% of India’s basmati rice exports go to 8 Middle Eastern countries, while the USA and UK account for just 9%.

Iran, Saudi Arabia, and Iraq make up 48% of total exports, with shipments to Iraq and Saudi having gone 2x in 2 years.

The Middle East has some of the highest GDP per capita in the world, with Qatar (#4), UAE (#6), Kuwait (#14), and Saudi (#17).

Basmati consumption per capita in the Middle East is 4x higher than in India.

With the ongoing geopolitical tensions (especially Iran), you can see how exporters would be severely impacted.

Basmati Rice top 10 export destinations and % of total export (Source: A Brief Report on Export of Rice by India Aug 2024)

3. Regulatory Shifts: How 2023 Impacted the Basmati Export Game

In the commodity world, the government is the ultimate game-changer. Regulations can boost companies by opening up markets or cause headaches with restrictions. Lets look at how the Indian government influenced the rice exports business over the last 2 years:

Initial Focus on Non-Basmati: Historically, India’s government has focused on regulating non-basmati rice exports, with basmati only subjected to quality and export controls.

July 2023 Non-Basmati Export Ban: To stabilize domestic prices amid production drops caused by flooding, the government imposed an export ban on non-basmati rice in July 2023.

MEP on Basmati Rice: In August 2023, a Minimum Export Price (MEP) of $1,200/ton was set for basmati rice to curb illegal exports of non-basmati rice under the guise of basmati shipments.

MEP Reduction & Removal: In October 2023, the MEP was reduced to $950/ton to ease export pressures, and by September 2024, the floor price was fully removed.

The impact of the MEP’s imposed on Basmati rice has been threefold:

Stockpiling inventory: Importers stockpiled basmati rice before the MEP was implemented.

Pakistan's Export Surge: Pakistan's basmati exports to Europe surged as Indian shipments slowed.

Domestic Price Drop: With basmati rice oversupplied in India (due to lower exports), domestic prices fell 15-20%.

Furthermore, India has yet to receive the PGI (Protected Geographical Indication) tag from the European Union which would grant Indian producers the exclusivity to use the ‘Basmati’ tag. If granted, this tag would significantly benefit Indian exporters, helping them regain market share in Europe, much of which was lost to Pakistan after the introduction of the MEP in 2023.

Basmati Rice export prices - Significant jump due to MEP imposed from Aug'23. (Screener)

Non-Basmati Rice - substantial decline in export value post ban. (Screener)

4. Unpacking the Business Model and its Evolution

Before we dive into the financials, it's essential to understand GRM Overseas’ business model. The company operates in both the export-heavy basmati rice sector and the domestic consumer staples space. Below is a breakdown of how their operations are structured (refer to the image).

Business model, FY24 revenue split, customer and product details (Company Annual Report)

Let’s understand each business model and how it has evolved over time:

Private Labeling: GRM initially started as a domestic rice supplier in the 1970s, but by the 1990s, private labeling for the MENA region had become its primary business focus. Today, 95% of the company’s exports are through private labels. It is currently the 2nd largest rice exporter in the MENA region and the 3rd largest in the world.

Own Brands International Launch: After two decades of private labeling, GRM launched its own value added Basmati rice brands in 2016 —Himalayan River (UK) and Tanoush (Gulf) to target international consumers through big retailers like Walmart, Tesco, and ASDA. However, these brands have struggled to gain significant traction, contributing just 5% to export revenues (as of FY24) and are yet to hit profitability.

Images depicting stagnant international brands business (Snippets from company's Investor Presentations and Annual Report)

GRM 2.0 Domestic Consumer Staples 10X Brand: In July 2020, GRM established a subsidiary to focus on the domestic market through 10X brand. This shift has paid off, with revenue from the domestic staples business growing from ₹58 Cr in FY21 to ₹257 Cr in FY24. Despite this growth, the distribution network (125+ distributors, 103K+ touch points) has not expanded since September 2021 (as per investor presentations). Most of the sales boost occurred in FY22 & FY23 with a degrowth in FY24, indicating possible stagnation in retail touch points.

No growth in retail touch points (Snippets from company's Investor Presentations and Annual Report)

Expanding FMCG portfolio with 10X Ventures: In addition to its ongoing NPD (New Product Development) efforts for the 10X brand—such as Ready-to-Eat (RTE) and Ready-to-Drink (RTD) products—GRM has been making a substantial push to grow its branded FMCG segment. The company has signed brand ambassadors like Saina Nehwal and Salman Khan to boost visibility, but a major value driver would be its newly established 10X Ventures investment platform (Aug’24). This would help combat its slow growing retail reach & expand its portfolio.

Details of the newly launched 10X Ventures investment platform (Source: Company filings)

5. Explosive Growth with Signs of Slowdown? A Look at Revenues

Now that we’ve understood the market dynamics and GRM’s business model, let’s have a look at its financial performance. Going forward, I'll also be comparing GRM’s performance with Chaman Lal Setia Exports Ltd, a company of similar size, business model and product mix, to get a clearer picture of how GRM has fared in key areas.

Both GRM Overseas and Chamanlal Setia have seen export revenue growth closely aligned with the overall rise in basmati rice exports, particularly to the MENA region (refer point 1). Their FY24 export revenues have nearly doubled compared to FY20. However, the introduction of the MEP (Minimum Export Price) in 2023, set at $1200/ton, has put downward pressure on export volumes, as the average export price for the past five years has been $975/ton, causing a dip in demand from certain key markets.

Revenue (INR Cr) of GRM Overseas over the last 5 years (Source: Filings)

Revenue (INR Cr) of CLSEL over the last 5 years (Source: Filings)

“Aim to derive 20% of its future revenue from new-age companies like Rage Coffee while maintaining its leadership in the rice, atta, and edible oil sectors”

GRM's domestic branded business (10X brand) has grown at a 3-year CAGR of 65%, climbing from ₹58 Cr in FY21 to ₹257 Cr in FY24. Despite this surge, the distribution network appears stagnant, and the plateau in growth from FY23 to FY24 hints that the company might be hitting a ceiling in terms of its current reach.

As the Minimum Export Price (MEP) has been removed and with this year’s basmati crop expected to be 15% higher YoY (following a 25% increase last year), there might significant revenue growth in the near term.

However, keep in mind that this is a commodity business and will be subject to VUCA in terms of cyclicality, government interventions and geopolitical tensions. Diversifying into domestic consumption would not only help margins but also provide stability in revenue.

Domestic revenue split (Source: Investor Presentations)

Recent Global Market Development: Iran, which constitutes >10% of India’s total Basmati rice exports, has banned imports for two months from October 21, 2024 to December 21, 2024 to support its local crop. Insurance companies have also stopped insuring exports to Iran. This will led to a substantial decrease in exports but on the flipside raw material paddy prices have also taken a plunge leading to better margins.

6. Why GRM’s Margins Took a Hit: The Cost of Commodities and Competition

Despite operating in the same market and having a similar product mix, GRM has seen an 11% contraction in gross margins over the last five years, while Chamanlal Setia has only experienced a 6% drop. This margin drop highlights GRM’s challenges in maintaining cost efficiency due to:

Rising Paddy Prices: The cost of paddy (PUSA 1509 variety) surged from INR 3,500/quintal in 2022 to INR 5,000/quintal in 2023.

Limited Pricing Power: As a company that derives most of its revenue from private labeling, GRM lacks the pricing power of branded players making it harder to pass on costs.

Inventory Management: While long-term customer contracts are crucial, GRM’s gross margin contraction implies it may not have optimized its market timing and inventory management effectively.

Even though 20% of GRM’s revenue comes from its 10X brand of products, their gross margins are below 15%. This has dragged down overall margins rather than boosting them. Compared to LT Foods’ branded staples business, which has 33% margins, GRM’s needs significant improvement to make a meaningful impact on overall profitability.

Gross margin trend over the last 5 years (Source: Company Filings)

7. EBITDA Margin Decline: Navigating Mounting Pressures

While Chamanlal Setia has managed to recover its EBITDA margins after a slight dip in FY21, GRM's margins have steadily declined over the years. This decline for GRM can be attributed to several external challenges and operational inefficiencies.

Rising Freight Costs: Freight charges surged over 3x during peak disruptions (Red Sea), especially affecting long-haul routes.

Extended Transit Times: Global trade disruptions have caused shipping times to lengthen by 2-3x, adding logistical burdens.

Stringent Export Norms: Key markets like the EU and several Gulf nations have imposed stricter pesticide residue norms, driving up compliance costs for exporters.

With the right mix of high-margin branded revenue and optimized export strategies, GRM Overseas has significant potential to follow in the footsteps of companies like KRBL, which has 15-20% EBITDA margins.

EBITDA Margin trend excluding Other Income (Source: Company Filings)

8. Rising Short Term Debt: Cause for Concern?

As GRM continues to scale, its net debt has doubled over the last five years, which is all short-term debt used to stock up on inventory.

GRM's net debt is significantly higher than Chaman Lal's, which operates with one-third the debt despite being of similar size.

While short-term debt allows GRM to capitalize on bulk buying, it also increases exposure to interest rate fluctuations and potential cash flow pressures.

With margins already under pressure, the high level of leverage poses a risk if inventory turnover slows or procurement costs rise further. The ROCE earned has to justify the cost of borrowing.

However, the company is also raising INR 136 Cr in share warrants from investors which would give it sufficient cushion.

Net Debt (Debt - Cash) in INR Cr over the years (Source: Company Filings)

9. Working Capital Efficiency: A Key Differentiator in Rice Exports

Since the rice export industry is highly seasonal, driven by the agricultural nature of the commodity, effective working capital management is crucial for success. Let’s take a look at how both of our companies perform:

Inventory Days: Both GRM and Chamanlal show elevated inventory days at year-end, reflecting the paddy procurement cycle in Oct-Nov. However, Chamanlal holds significant inventory consistently, which may have helped it hedge against rising paddy costs, thereby having higher gross margins.

Debtor Days: Chamanlal's debtor days are less than 60, significantly lower than GRM’s, which hovers over 120 days (2x of Chamanlal). This indicates that Chamanlal likely has better contract terms and payment collection efficiency, reducing working capital strain.

Creditor Days: Both companies show minimal creditor days as they typically purchase paddy on a spot basis, limiting the use of credit.

However, due to the intensive working capital nature of business, cashflow is always blocked in either inventory or debtors. For reference, the 5 year cumulative cashflow from operations of GRM Overseas was INR 40 Cr & Chamanlal Setia was INR -1 Cr.

GRM - Working capital trends over the last 5 years (Source: Filings)

CLSEL- Working capital trends over the last 5 years (Source: Filings)

10. Rationale for the 44% Stake Acquisition: GRM Overseas’ Perspective

Let’s explore the rationale behind this acquisition and how it fits into GRM’s long-term plans:

Reviving Shareholder Value: GRM Overseas is a ₹1,400 Cr market cap company, and its share price peaked at over INR 850 in January 2022. However, the past few years have seen significant margin compression at both the gross margin and EBITDA levels, alongside rising leverage, leading to a 70% decline in its stock price (currently INR 236). To rebuild shareholder value and command a higher multiple for possible rerating, GRM will likely need to pivot towards higher-growth, higher-margin businesses.

Diversifying from Commoditized Basmati Exports: GRM's private label Basmati export business has become increasingly challenging due to rising input costs, strict government regulations like MEP, and geopolitical risks in key markets like the Middle East. These factors make it difficult to pass on higher costs to customers, leading to squeezed margins. By investing in high-margin, branded consumer products like Rage Coffee, GRM can diversify away from the highly competitive and lower-margin commoditized export segment, creating a more balanced revenue mix.

Leveraging Brand Value & Product Portfolio Expansion: Rage Coffee comes with an already established brand presence, which GRM can capitalize on without the need to build a brand from scratch. While Rage lacks the funding and distribution reach to fully tap into its brand potential, GRM’s acquisition provides a shortcut to scale. Moreover, GRM’s own branded business (10X) has struggled in FY24, so acquiring Rage Coffee and other D2C brands allows GRM to quickly expand its product portfolio and boost brand-driven revenues with minimal time to market.

Synergies in Domestic & International Markets: Both GRM and Rage Coffee serve similar domestic and export markets, creating natural synergies. By pushing Rage Coffee’s products through GRM’s extensive network, GRM can leverage its established relationships and market knowledge, while Rage Coffee gains immediate access to a broader distribution network.